[Notification of Payment and Confirmation] Special Emergency Support Payment for Households Exempt from Resident Tax (30,000 yen)

In order to alleviate the burden on low-income households significantly affected by rising prices of food and other goods, a flat-rate resident tax exemption of 30,000 yen per household will be provided for households that are exempt from taxation in fiscal year 2024. If there are children under 18 years old (born on or after April 2, 2006) in the same household, an additional 20,000 yen will be added for each eligible child. Furthermore, this benefit will be treated as non-taxable and exempt from seizure under the law.

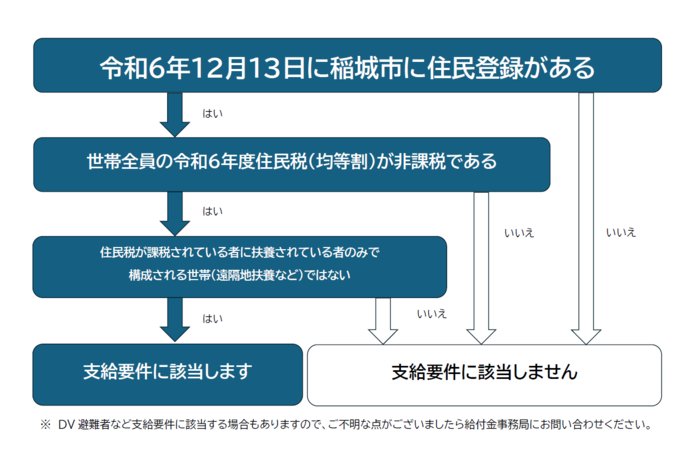

Eligible Households

As of December 13, 2024 (reference date), households registered as residents in Inagi City, where all members are exempt from the Municipal Resident Tax per capita levy for the fiscal year 2024.

- Only for newborns, children born on or after the day following the reference date may be eligible for the child allowance if they meet the requirements. If you think you may qualify, please consult with us.

- If you are taking refuge in Inagi City due to violence from a spouse or other relatives, you may be eligible for benefits if you meet certain requirements. If you think you may qualify, please consult with us.

Households that fall under any of the following categories are not eligible

- Households with members who are subject to Municipal Resident Tax outside of Inagi City

- Households with individuals who have income subject to resident tax but have not filed a declaration

- Households composed only of those who are supported by individuals subject to resident tax (remote support, etc.)

- Households that have submitted a Notification for the application of tax treaties regarding the exemption from the resident tax flat-rate as of the reference date

- Households that separated from the same address after the reference date and received benefits before the separation, as well as other households at the same address.

Procedure Method

For the eligible households, notification of payment (payment notice) or confirmation of payment requirements (hereinafter referred to as "confirmation document") is being sent out sequentially.

In the case of payment notification

Payments will be made to the account listed in the notification without any procedures, starting from early April, in order.

Note: Notification of payment (Notice of payment) is sent in a light blue envelope.

Note: If you wish to change your receiving account or decline the benefits, please contact the inquiry office by Wednesday, March 19.

In the case of a confirmation letter

Confirmation letter in light green envelope will be sent sequentially, so please apply using one of the following methods.

Note: If you do not receive the confirmation letter by Thursday, March 13, please contact us.

(1) Online Application

Please have your My Number Card ready, scan the QR code listed on the confirmation document, access the dedicated site, and submit your electronic application.

Note: If you have not registered a public fund receiving account, please register your public fund receiving account first, and then apply for the benefits the following day or later.

(2) Return of Confirmation Document

Please fill in the required information on the confirmation form, attach a copy of your identification documents and bank account information, and return it using the enclosed reply envelope.

Note: Households that include individuals who moved to Inagi City on or after January 2, 2024, and households that have not filed for the Municipal Resident Tax for the fiscal year 2024 may not receive a confirmation letter. If you believe you are eligible for benefits, please obtain the Application Form yourself and apply by mail.

In the case of Application Form

Please fill out the necessary information on the Application Form, attach a copy of your identification documents, bank account information, and the non-taxable certificate for all household members for the 6th year of Reiwa, and apply by mail.

Note: The Application Form can be obtained by downloading the PDF data below or at City Hall, Hirao and Wakabadai Branch Office, and each Cultural Center.

Download Application Form for Temporary Key Support Payment for Households Exempt from Resident Tax

- Subsidy Application Form (PDF 2.2MB)

- Reply Envelope (PDF 510.8KB)

- Application for Evacuation due to DV, etc. (PDF 308.2KB)

- Confirmation of Receipt of Application for DV Victim (PDF 205.0KB)

- Download the Application Form and the reply envelope PDF file from the link above and print it.

- Fill out the necessary items on the Application Form by hand. (Please do not use erasable pens or pencils.)

- Put the necessary documents in a return envelope and send them by mail.

Note: If you do not have a printing environment such as a printer at home, please use the printing services introduced below.

Note: If you use the above reply envelope, you can send it without affixing a stamp.

If you are unable to print the application form at home (Information on convenience store printing services)

Even if you do not have a printing environment such as a printer at home, you can use paid printing services at nearby convenience stores to print application forms and other documents.

For more details, please see the linked page.

-

Network Print Service (FamilyMart, Poplar Group, Lawson)(External Link)

-

netprint (Seven-Eleven) (external link)

-

Network Print (Ministop)(External Link)

Note: You may need to download the app and register for a free membership to use the printing service.

Note: Printing fees will apply when you print.

Note: If you are using netprint (Seven-Eleven), please refer to the FAQ (Frequently Asked Questions) below.

Method of Payment

After receiving the documents, we plan to transfer the funds sequentially to the bank account in the name of the head of the household.

Note: If there is a concentration of applications, it may take time to receive benefits. Additionally, if there are omissions in filling out the documents or deficiencies in the attached documents, benefits cannot be received.

Application Deadline for Confirmation and Application Forms

In the case of online application (confirmation letter only)

Until June 16 (Monday) at 11:59 PM. Applications will not be accepted after the deadline.

In case of mailing

Must arrive by June 16 (Monday). Submissions will not be accepted after the deadline.

Frequently Asked Questions (Q&A)

Who will receive the benefits?

The person receiving the benefits (beneficiary) will be the head of the household (as of the reference date) of the eligible household.

How do I receive the benefits?

In principle, payments will be made to the bank account in the name of the head of the household.

Fiscal Year 2023 Special Temporary Benefits for Households Exempt from Resident Tax and Special Focus Support Benefits for Households Exempt from Resident Tax, as well as the New Temporary Focus Support Benefits for Households Exempt from the Resident Tax Income Portion for Fiscal Year 2024 have been received. Are these benefits available this time?

Households that have received the above-mentioned benefits will also be eligible for the temporary priority support grant for households exempt from resident tax if they meet the eligibility requirements.

When will the payment notification and confirmation letter be sent?

Notification or confirmation letters have been mailed to the eligible households. If you do not receive it by Thursday, March 13, please contact us.

When will the benefits be paid?

(1) In the case of payment notification

Starting from early April 2025, payments will be transferred sequentially to the bank accounts listed in the payment notification.

(2) Confirmation Document (Online)

The payment will be transferred to the designated public funds receiving account approximately 1 to 1.5 months after the application is completed.

(3) In the case of a confirmation document (paper)

The payment will be made to the designated financial institution account approximately 1.5 months after the date the Mayor of Inagi City receives the "complete" confirmation document.

Note: If there is a high concentration of applications, it may take longer.

The head of the household is physically disabled and cannot sign the confirmation letter or application form. What should I do?

If it is difficult for the individual to return the confirmation document or submit the Application Form, it is also possible for a representative to do so.

Proxy applications are possible by members of the household to which the applicant belongs, legal representatives, relatives, and others who regularly take care of the applicant, as specifically recognized by the mayor.

In the case of a confirmation document, please fill in the information of the representative in the delegation section on the back and attach the necessary documents. In the case of an application form, you will need to submit copies of the identification documents of the head of the household and the representative.

Note: If you absolutely wish to transfer to an account other than that of the head of the household due to circumstances, please consult us.

Are foreigners eligible for the benefits?

As of the reference date (December 13, 2024), if you are registered as a resident in Inagi City and meet all the conditions for "eligible households," foreign residents will also be eligible for the benefits.

However, households that have submitted a Notification for the application of a tax treaty regarding the exemption from the resident tax flat rate as of the reference date are excluded.

Are households receiving Public Assistance eligible for benefits?

Households receiving Public Assistance are also eligible for benefits.

However, households that have a reduced rather than exempt resident tax for the fiscal year 2024 are not eligible.

In addition, this grant is not recognized as income under the Public Assistance system.

Are households subject only to the resident tax uniform tax eligible for the benefit?

Households subject only to the resident tax uniform tax will not be eligible for this benefit.

I am fleeing from domestic violence from my spouse. In a household with a Certificate of Residence, my spouse has received benefits. Am I not eligible to receive benefits?

Even if the household with a Certificate of Residence (spouse) has already received the benefits, you can receive benefits from the municipality where you currently reside if you meet the requirements (proof of being in a situation such as domestic violence evacuation and being exempt from the Municipal Resident Tax flat-rate).

Beware of scams disguised as benefits!

There may be inquiries from Inagi City to your home, but we will absolutely never ask you to operate an automated teller machine (ATM), request your cash card or credit card PIN, or ask for a transfer of fees for benefits.

If you receive any suspicious phone calls or mail, please contact the inquiry below or your nearest police station.

Contact Information

Inagi City Benefits Office (Livelihood Welfare Division Benefits Section)

Phone Number: 042-401-5321

Reception Hours: 9 AM to 5 PM (excluding Saturdays, Sundays, and holidays)

[Hearing Impaired Consultation Window]

Fax Number: 042-401-5322

Inquiry Form

Please access the inquiry form below. Available 24 hours.

To view the PDF file, you need "Adobe(R) Reader(R)". If you do not have it, please download it for free from Adobe website (new window).

Please let us know your feedback on how to make our website better.

Inquiries about this page

Inagi City Benefits Office (Livelihood Welfare Division Benefits Section)

Phone Number: 042-401-5321 Fax Number: 042-401-5322

Contact Inagi City Welfare Department Livelihood Welfare Division