Proper Management of Vacant Houses

What is a vacant house?

"Vacant houses" are defined in the "Act on Special Measures for the Promotion of Measures against Vacant Houses" as "buildings or structures attached to them that are not used for residence or other purposes on a regular basis, as well as their premises (including trees and other objects fixed to the land)."

Vacant houses can deteriorate if left unattended, causing inconvenience to the surrounding area and potentially leading to dangerous situations. Additionally, there are risks in terms of costs, such as the need for repairs and maintenance, and the possibility of increased Property Tax on residential land.

It is important to manage vacant houses properly and consider selling or utilizing them as soon as possible.

Mismanaged Vacant Houses, etc.

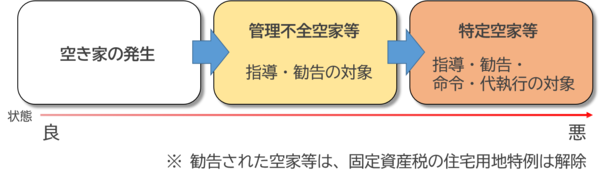

"Poorly Managed Vacant Houses" are vacant houses that may deteriorate into "Designated Vacant Houses" if left unattended.

They are subject to guidance and recommendations, and if the situation does not improve despite receiving guidance, a recommendation will be issued, and the special measures for Property Tax on residential land will be revoked.

Specific Vacant Houses, etc.

"Specific vacant houses, etc." refers to vacant houses, etc. that are recognized as being in the following conditions.

- A state that poses a significant safety risk of collapse if left unattended

- A condition that may become significantly harmful to health if left unattended

- A state that significantly damages the landscape due to inadequate management

- A condition in which it is inappropriate to leave unattended in order to preserve the surrounding living environment.

Subject to guidance, recommendations, and orders, the special measures for Property Tax will be lifted, and if the measures are not fulfilled, it will be subject to substitute execution.

The management of vacant houses is the responsibility of the owners and others.

Owners or managers of vacant houses must strive to manage the vacant houses properly to avoid negatively impacting the surrounding living environment, and they must also make efforts to cooperate with the policies regarding vacant houses implemented by the national government, prefectures, and municipalities.

If proper management is not carried out and the vacant house falls into a state of mismanagement, causing harm to third parties, the owners may be held responsible for management.

Contact Form for Improperly Managed Vacant Houses

If you are experiencing issues with vacant houses that are not properly managed and are negatively affecting the surrounding living environment, please provide information using the form below.

Brochure on Vacant Houses: "Is Your Vacant House Okay?"

The city has created a brochure about vacant houses titled "Is Your Vacant House Okay?" in collaboration with Gichitai Ad Co., Ltd. It is also distributed at the Community Development and Regeneration Division on the 3rd floor of City Hall.

(Note: The currently displayed and distributed brochure contains information as of March 2023.)

Consultation for Vacant Houses

This section provides information on inheritance, pruning and cutting of plants, demolition and renovation of houses, and consultation services regarding vacant houses.

Please make use of it according to your concerns.

Vacant House One-Stop Consultation Center (Tokyo)

In Tokyo, we are implementing a comprehensive approach to raise awareness about the prevention, effective use, and proper management of vacant houses, along with a one-stop consultation service that responds to inquiries from vacant house owners free of charge.

Certificate Required for Special Deduction on Capital Gains from Transfer of Vacant Houses

As a special measure to suppress the occurrence of vacant houses, when transferring an inherited vacant house or the land of a vacant house, a special deduction of 30 million yen will be applied to the capital gains. To receive this special deduction, it is necessary to attach the "Certificate of Residential Property of the Deceased" issued by the municipality where the vacant house is located to the tax return.

If you need the "Certificate of Residential Property of the Deceased," please check the link below and apply to the Community Development Regeneration Division.

Note: To receive this special exception, certain requirements must be met. For details and applicability, please check the websites of the Ministry of Land, Infrastructure, Transport and Tourism and the National Tax Agency, or contact your local tax office.

Designation of Support Corporations for the Management and Utilization of Vacant Houses, etc.

In Inagi City, until the city's policy is established regarding the designation of support organizations for the management and utilization of vacant houses, no designations will be made.

To view the PDF file, you need "Adobe(R) Reader(R)". If you do not have it, please download it for free from Adobe website (new window).

Please let us know your feedback on how to make our website better.

Inquiries about this page

Inagi City Department of Urban Development Community Development Rebirth Division

2111 Higashi-Naganuma, Inagi City, Tokyo 206-8601

Phone number: 042-378-2111 Fax number: 042-378-9719

Contact Inagi City Department of Urban Development Community Development Rebirth Division