About proper management of vacant houses

Updated: August 22, 2024

What is a vacant house?

"Vacant houses, etc." are defined in the "Act on Special Measures Concerning Promotion of Vacant Houses, etc. Countermeasures" as "buildings or attached structures that are not habitually occupied or otherwise used, and their premises. (including standing trees and other things that settle on land)".

If a vacant house is left unattended, it is expected that its condition will worsen, causing a nuisance to the surrounding area and creating a dangerous situation. Additionally, there are cost risks, such as the need for repairs and maintenance, as well as the possibility of an increase in property taxes on residential land.

Properly manage vacant houses and consider selling or reusing them as soon as possible.

Poorly managed vacant houses, etc.

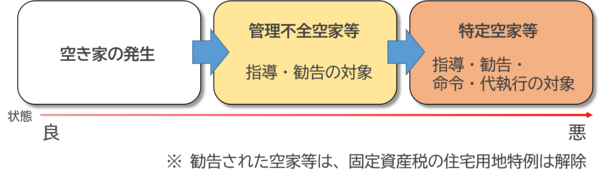

"Poorly managed vacant buildings, etc." are vacant buildings, etc. that, if left as they are, are likely to become "specified vacant buildings, etc.", which are in worse condition.

If you are subject to guidance and recommendations, and the situation does not improve even after receiving guidance, you will receive a recommendation and the special measures for property taxes on residential land will be lifted.

Specified vacant houses, etc.

"Specified vacant buildings, etc." are vacant buildings, etc. that are recognized to be in the following conditions.

(1) If left as is, there is a risk of collapse or other significant safety hazards.

(2) Conditions that could be extremely hazardous to hygiene if left untreated.

(3) The landscape is severely damaged due to lack of proper management.

(4) Other conditions where it is inappropriate to leave them unattended in order to preserve the surrounding living environment.

They will be subject to guidance, recommendations, and orders, and special measures for property taxes will be lifted, and if the measures are not implemented, they will be subject to proxy execution.

Management of vacant houses is the responsibility of the owners, etc.

The owner or manager of a vacant house must endeavor to manage the vacant house appropriately so as not to have a negative impact on the surrounding living environment, and also to cooperate with measures regarding vacant houses implemented by the national, prefectural, and municipal governments. not.

If a vacant house is not managed properly and a third party is harmed, the owner may be held responsible for the management.

Contact form for unmanaged vacant houses

If you are experiencing problems with vacant houses that are not being properly managed or are having a negative impact on the surrounding living environment, please provide us with information using the form below.

Contact form for unmanaged vacant houses

Pamphlet about vacant houses: “Is your vacant house safe?”

The city has created a pamphlet about vacant houses, ``Is Your Vacant House Safe?'' in an agreement with Jichitiad Co., Ltd. They are also distributed at the Town Development and Revitalization Division on the 3rd floor of City Hall.

(Note: The pamphlets currently posted and distributed are as of March 2020.)

![]() Is your vacant house okay? (PDF: 7,486KB)

Is your vacant house okay? (PDF: 7,486KB)

Consultation regarding vacant houses

The website lists contact information for advice regarding vacant houses, such as matters relating to inheritance, pruning and felling of plants, demolition and renovation of houses, etc.

Please use it according to the problem you are having.

![]() Contact information for vacant houses (PDF: 157KB)

Contact information for vacant houses (PDF: 157KB)

Vacant house one-stop consultation counter (Tokyo)

The Tokyo Metropolitan Government is implementing an integrated effort to raise awareness regarding the prevention, effective use, and proper management of vacant houses, as well as a one-stop consultation service that provides free consultation from owners of vacant houses.

![]() Vacant house one-stop consultation counter

Vacant house one-stop consultation counter

Confirmation document required for special deduction of capital gains from vacant houses

As a special measure to prevent the occurrence of vacant houses, if you transfer an inherited vacant house or the site of a vacant house, a special deduction of 30 million yen will be made from the transfer income. In order to receive this special deduction, it is necessary to attach the "Decedent's Residential House Confirmation Form" issued by the municipality where the vacant house is located to the final tax return.

If you need a "Decedent's Residential House, etc. Confirmation Form", please check the link below and apply to the Town Development and Revitalization Division.

Note: There are certain requirements in order to qualify for this special provision. For details and applicability, please check the websites of the Ministry of Land, Infrastructure, Transport and Tourism and the National Tax Agency, or contact your local tax office.

Regarding the designation of a corporation that supports the management and utilization of vacant buildings, etc.

Inagi City will not designate a corporation that supports the management and utilization of vacant properties until the city's policy is established.

Adobe Acrobat Reader DC (formerly Adobe Reader) is required to open PDF files.

If you don't have it, you can download it for free from Adobe.

![]() Download Adobe Acrobat Reader DC

Download Adobe Acrobat Reader DC

Inquiries regarding this page

Inagi City Urban Construction Department Town Development and Revitalization Division

2111 Higashi-Naganuma, Inagi-shi, Tokyo

Phone: 042-378-2111 Fax: 042-378-9719