Main changes to municipal tax and Tokyo inhabitant tax in 2012

Updated: May 29, 2012

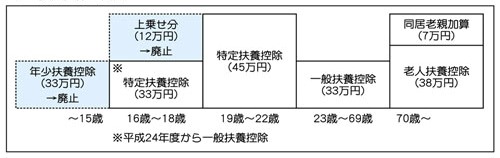

Revision of exemption for dependents

The dependent deduction (330,000 yen) for young dependent relatives (dependent relatives under the age of 16) will be abolished.

In addition, the additional portion of the dependent deduction (120,000 yen) for specified dependent relatives (16 years old or older and under 23 years old) who are 16 years old or older and under 19 years old will be abolished, and the dependent deduction will be 330,000 yen.

*The number of young dependents will continue to be included in the per capita rate and income rate tax exemption determinations.

Summary of deduction for dependents

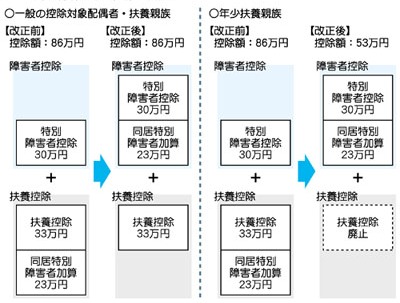

Reorganization of special measures for cohabiting special disability addition

Due to the abolition of the dependent deduction for young dependent relatives, if you support a person with special disabilities and live with them, instead of adding 230,000 yen to the amount of dependent deduction or spouse deduction, 230,000 yen will be added to the amount of special disability deduction. The measure will be revised to add 10,000 yen.

Overview of special deduction for persons with disabilities living together

Reduction of the minimum applicable amount of tax credit for donations

The minimum amount applicable for donation tax deduction has been lowered from 5,000 yen to 2,000 yen.

*Applicable to donations made after January 1, 2011.

Donation tax system for individual inhabitant tax was expanded (hometown tax)

Extension of reduced tax rate for listed stocks, etc.

The period of application of the 10% reduced tax rate (7% income tax, 3% municipal/municipal tax) on dividends and capital gains from listed stocks, etc. has been extended by two years to December 31, 2013.

Inquiries regarding this page

Inagi City Citizens Department Taxation Division

2111 Higashi-Naganuma, Inagi-shi, Tokyo

Phone: 042-378-2111 Fax: 042-370-7055