Main changes to municipal tax and Tokyo inhabitant tax in 2014

Updated: February 14, 2014

Revision of per capita rate

With the aim of recovering from the Great East Japan Earthquake, the Act on Temporary Exceptions to Local Taxes was enacted so that local governments can voluntarily secure financial resources for disaster prevention projects.

In response to this, in order to secure financial resources related to these projects in our city, we decided to raise the per capita amount of municipal tax and metropolitan inhabitant tax by 500 yen each for 10 years from 2014 to 2023.

Per capita rate (annual amount) |

Before revision |

After revision |

|---|---|---|

Metropolitan Resident Tax |

1,000 yen |

1,500 yen |

municipal tax |

3,000 yen |

3,500 yen |

total |

4,000 yen |

5,000 yen |

The period of raising caution is 10 years from 2014 to 2023

Revision of salary income deduction amount

If the amount of income from salary, etc. exceeds 15 million yen, the deduction for employment income is set at 2.45 million yen.

| Amount of income from salary, etc. | Salary income deduction amount | |

|---|---|---|

| Before revision | After revision | |

| More than 10 million yen and up to 15 million yen | Amount of income from salary x 5% + 1.7 million yen | Amount of income from salary x 5% + 1.7 million yen |

| Over 15 million yen | 2.45 million yen | |

Note: The amount of employment income is the amount obtained by subtracting the deduction for employment income from the amount of income from salary, etc.

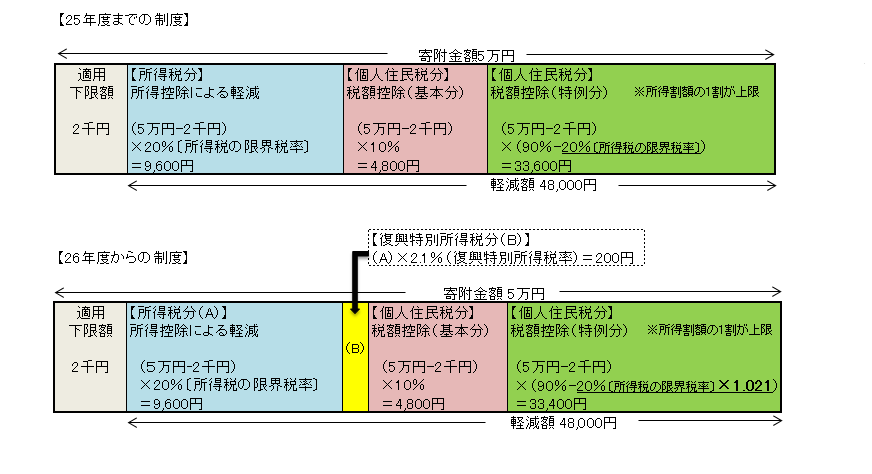

Amendment of Hometown Donation Tax Credit in Accompaniment with the Establishment of Special Reconstruction Income Tax

Special income tax for reconstruction (2.1%) will be levied from 2013 to 2047. Along with this, if the donation deduction is applied, the special income tax for reconstruction will also be reflected, so the special deduction for hometown donations on municipal and metropolitan inhabitant taxes will be adjusted. If it is within 10% of the amount, there is no change in the amount of the donation tax credit, which is the sum of income tax (including special income tax for reconstruction), municipal tax and metropolitan inhabitant tax).

Hometown donation tax deduction = basic deduction + special deduction

| Hometown donation tax credit | Before revision | After revision |

|---|---|---|

| Basic deduction amount | (donation amount - 2,000 yen) x 10% | |

| Exceptional deduction | (donation amount - 2,000 yen) x (90% - applicable tax rate of income tax) | (donation amount - 2,000 yen) x (90% - applicable tax rate of income tax x 1.021) |

Amendments to special deductions for employment income earners

In order to expand the opportunities for actual deductions for employment income earners, it was decided to add the following expenditures to the scope of specified expenditures.

1 Expenses for acquiring qualifications such as lawyers, certified public accountants, and tax accountants directly necessary for the performance of duties

2 Expenses for purchasing books, clothes worn in the workplace, and entertainment expenses normally required for duties, which are certified by the payer of salaries, etc. as directly necessary for the performance of duties (up to 650,000 yen)

Revisions regarding public pension recipients (simplification of reporting procedures for widow (widow) deduction)

From the viewpoint of simplifying the declaration procedure for public pension recipients, etc., if a widow (widow) deduction is declared in the deduction for dependents submitted to the pension insurer, the pension insurer will send it to the city. Since the widow (widow) deduction is reported in the public pension payment report, it is no longer necessary to declare the widow (widow) deduction.

Inquiries about this page

Inagi City Citizens Department Taxation Division

2111 Higashi-Naganuma, Inagi-shi, Tokyo

Phone: 042-378-2111 Fax: 042-370-7055