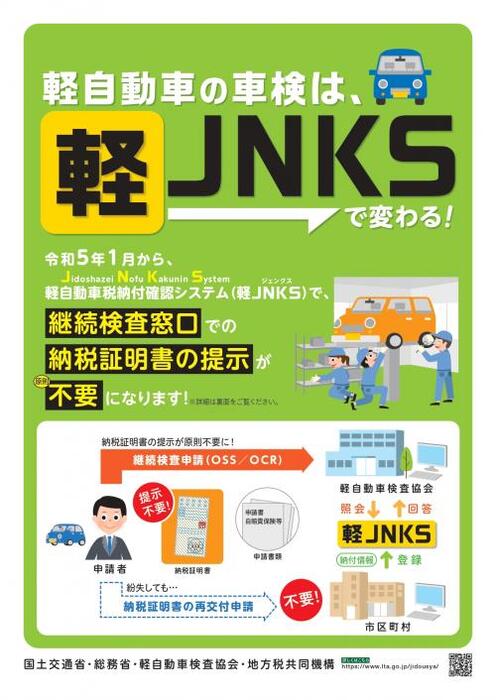

It is no longer necessary to present a tax certificate at the time of vehicle inspection for light vehicles (excluding motorcycles)

Update date: January 10, 2023

From January 2020, the “Light Vehicle Tax Payment Confirmation System (Light JNKS)” will start.

Once light JNKS starts, payment can be confirmed at the light vehicle inspection association nationwide, so in principle, it will no longer be necessary to "present a tax payment certificate" at the continuation inspection window during vehicle inspection.

However, small two-wheeled vehicles (displacement over 250cc) are not eligible, so a tax payment certificate must be presented.

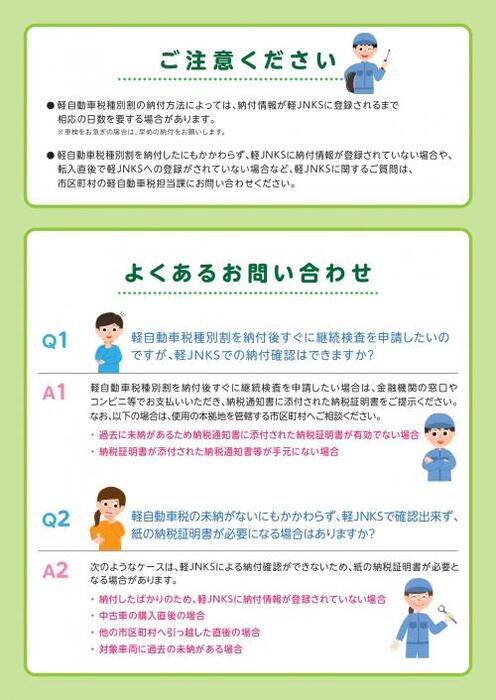

In the following cases, a paper tax certificate may still be required.

- If the payment information is not registered in the light JNKS because it has just been paid (it will take about 1 to 2 weeks until the payment information can be confirmed)

- If the target vehicle has a past payment arrears

- Immediately after a name change (purchasing a used car, etc.)

- If you have just moved from another city, ward, town or village

- For motorcycles (not subject to the light JNKS)

Information about light JNKS

![]() Light JNKS leaflet (PDF: 1,518KB)

Light JNKS leaflet (PDF: 1,518KB)

To open PDF files, you need Adobe Acrobat Reader DC (formerly Adobe Reader).

If you don't have it, you can download it for free from Adobe.

![]() Download Adobe Acrobat Reader DC

Download Adobe Acrobat Reader DC

Inquiries regarding this page

Inagi City, Citizens' Affairs Department, Collection Division

2111 Higashi-Naganuma, Inagi-shi, Tokyo

Phone: 042-378-2111 Fax: 042-378-2207