We are recruiting for the corporate version of hometown tax donation

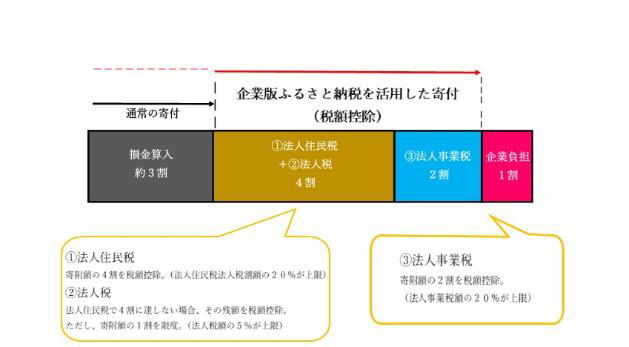

The corporate hometown tax donation system is a mechanism that allows companies that support local revitalization initiatives carried out by local governments through donations to receive tax benefits. Donations received from companies will be allocated to the projects listed below. We are seeking companies that agree with our initiatives and can support us through the corporate hometown tax donation (local revitalization support tax system).

Note: We had suspended recruitment to prepare for accepting corporate hometown tax donations, but we have resumed recruitment from August 19, 2024.

Project Introduction

Support for Inagi City Junior High School Club Activities

In order to improve the qualities of students and to foster a lifelong engagement with sports and culture, as well as to reform the working styles of School Faculty and Staff, we are requesting private companies to send instructors to the extracurricular activities of Inagi City Junior High Schools.

By utilizing personnel with extensive experience and actively promoting interaction among students belonging to junior high school club activities, we can bridge the gaps in the level of guidance and environment.

Additionally, we aim to strengthen public-private partnerships aimed at reforming work styles in public schools, while also leading to the sustainable management of club activities.

Furthermore, we will also utilize this to enhance the club activity environment.

Other Topics

We will utilize the projects described in the Regional Revitalization Plan (Inagi City Community, People, and Business Startup Promotion Plan).

Points to Consider When Using the System

- Donations of 100,000 yen or more per time are eligible.

- It is prohibited to provide economic benefits to companies as a compensation for making donations.

- Donations from companies with their headquarters located in this city are not eligible for this system. (In this case, the headquarters refers to the "main office or business office" as defined by the Local Tax Law.)

- Corporations that submit blue tax returns are eligible.

- The special measures for tax deductions under this system are scheduled until the fiscal year 2024.

- For procedures (declaration) and calculations regarding tax deductions, please consult the relevant tax office or metropolitan tax office.

- For more details about the system, please also refer to the Cabinet Office's Corporate Version Furusato Tax Portal Site.

Consultation and Procedures for Donations

Please contact the General Affairs Department General Affairs and Contracts Division.

Phone 042-378-2111 (Extension 512)

Email soumu@city.inagi.lg.jp

We will send you the donation request form.

Introduction of companies that made donations in Fiscal Year 2023

| Company Name | Donation Amount |

|---|---|

| Buddy Planning Research Institute Co., Ltd. | 7.25 million yen |

| B.C.I.S Co., Ltd. | 700,000 yen |

| Tokyo Photography and Arts Co., Ltd. | Amount not disclosed |

| Strike Co., Ltd. | Amount not disclosed |

To view the PDF file, you need "Adobe(R) Reader(R)". If you do not have it, please download it for free from Adobe website (new window).

Please let us know your feedback on how to make our website better.

Inquiries about this page

Inagi City General Affairs Department General Affairs and Contracts Division

2111 Higashi-Naganuma, Inagi City, Tokyo 206-8601

Phone number: 042-378-2111 Fax number: 042-377-4781

Contact Inagi City General Affairs Department General Affairs and Contracts Division