Last updated: August 21, 2024

Corporate hometown tax is a system that allows companies that support the regional revitalization efforts of local governments through donations to receive tax benefits, and donations received from companies will be used for the following projects. We are looking for companies that agree with our city's efforts and would like to support us through corporate hometown tax (regional revitalization support tax system).

Note: We had suspended applications in preparation for accepting corporate hometown tax donations, but resumed applications from August 19, 2024.

Private companies dispatch instructors to club activities at Inagi Municipal Junior High School in order to improve the quality of students and familiarize them with sports and culture throughout their lives, as well as to reform the way teachers work.

By promoting interaction between students belonging to junior high school clubs and people with a wealth of experience, we can bridge the gap in teaching standards and environments.

In addition, we will aim to ensure the sustainable management of club activities and strengthen public-private partnerships aimed at work style reform in public schools.

In addition, we will use it to improve the club activity environment.

The funds will be used for the projects listed in the Regional Revitalization Plan (Inagi City Town, People, and Jobs Revitalization Promotion Plan).

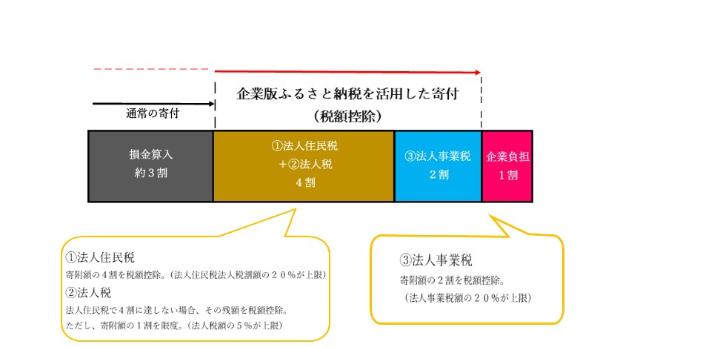

Example) If you donate 1 million yen, the maximum corporate tax will be reduced by approximately 900,000 yen.

Please contact the General Affairs and Contracts Division of the General Affairs Department.

Phone: 042-378-2111 (ext. 512)

Email: soumu@city.inagi.lg.jp

A donation application will be sent to you.

| Company name | Donation amount |

|---|---|

| Buddy Planning Institute Co., Ltd. | 7.25 million yen |

| BCIS Co., Ltd. | 700,000 yen |

| Tokyo Photo Crafts Co., Ltd. | Amount not disclosed |

| Strike Co., Ltd. | Amount not disclosed |

Inagi City General Affairs Department General Affairs Contract Division Phone: 042-378-2111