Last updated: April 1, 2023

[Notes on system changes due to the tax reform in fiscal year 2023]

Due to the tax reform in fiscal year 2023, the requirements and contents of the special exemption for fixed assets tax have been revised. In addition, due to the revision of the provisions related to the introduction plan of advanced equipment, etc. in the Enforcement Regulations of the Small and Medium Enterprise Management Strengthening Act dated April 1, 2023, the format of the application form, etc. has been changed.

Note: Please note that applications cannot be submitted using the old format.

The "Advanced Equipment Introduction Plan" is a plan for small and medium-sized enterprises stipulated in the Small and Medium Enterprise Management Strengthening Act to improve labor productivity through capital investment. Inagi City received approval from the national government on April 1, 2020 for the "Basic Plan to Promote the Introduction of Equipment," and has certified the "Plan for the Introduction of Advanced Equipment, etc." drawn up by small and medium-sized businesses in the city.

If you are certified, you can receive tax support and financial support as follows.

(1) Tax support (Special provisions for fixed asset tax related to depreciable assets that contribute to productivity improvement)

Based on the "Advanced Equipment Introduction Plan" certified by Inagi City, if small and medium-sized enterprises, etc. introduce new equipment that contributes to improving labor productivity within the applicable period, the fixed asset tax for that equipment will be levied as follows: Measures can be taken.

Note: Applicable period is from April 1, 2023 to March 31, 2025 (2 years)

| item | Content |

|---|---|

| Period and special rate | 3 years, special rate 1/2 |

Period/special rate (if there is an announcement of wage increase) |

(1) Equipment acquired by March 31, Reiwa 6 |

Equipment requirements |

Equipment essential to achieving the investment objectives set out in the investment plan that is expected to produce an average annual return on investment of 5% or more |

Target equipment notes: Limited to those taxed as depreciable assets |

(1) Machinery and equipment (1.6 million yen or more) |

(2) Financial support <br id="3"/>When small and medium-sized enterprises receive a loan from a private financial institution to implement the "Advanced Equipment Introduction Plan" certified by Inagi City, they receive a credit guarantee from the Credit Guarantee Association. Of these, you can receive additional guarantees that are separate from the regular insurance coverage. If you are considering using it, please consult with the relevant organizations before applying for certification of the "Advanced Equipment Introduction Plan".

The related organizations are as follows.

Note: For other details about the Small and Medium Enterprise Management Strengthening Act, please see the Small and Medium Enterprise Agency website below. For details on "Procedures for receiving special measures for fixed asset taxes," please see "Procedures for receiving special measures for fixed asset taxes" at the bottom of the page.

In accordance with the Small and Medium Enterprise Management Strengthening Act, Inagi City accepts and reviews applications for certification of "Advanced Equipment Introduction Plans" formulated by small and medium enterprises with business establishments in the city in order to improve labor productivity to a certain level or more. Certification is granted only if the plans match Inagi City's "Basic Plan for Promoting Introduction."

The table below shows the size of small and medium-sized enterprises that can receive certification.

| Industry classification | Amount of capital or total amount of investment | Number of employees used at any given time |

|---|---|---|

| Manufacturing industry and others (notes: 1) | Less than 300 million yen | 300 or less |

| Wholesale | Less than 100 million yen | 100 or less |

| retail industry | 50 million yen or less | 50 people or less |

| service industry | 50 million yen or less | 100 or less |

| Rubber products manufacturing industry (note: 2) | Less than 300 million yen | 900 people or less |

| Software industry or information processing service industry | Less than 300 million yen | 300 or less |

| Inn business | 50 million yen or less | 200 people or less |

Note 1: "Manufacturing and others" applies to industries other than the above-mentioned "wholesale trade" to "hotel business".

Note 2: Excludes automobile or aircraft tire and tube manufacturing industry and industrial belt manufacturing industry.

In addition, business associations, cooperatives, business cooperatives, etc. can also receive certification for their plans to introduce cutting-edge equipment.

In order to receive certification from Inagi City, eligible small and medium-sized enterprises must formulate an "Advanced Equipment Introduction Plan" to increase labor productivity by an average of 3% or more per year during the planning period compared to the base year (the end of the most recent business year).

The main requirements are listed in the table below.

| Key requirements | content |

|---|---|

| planning period | 3, 4 or 5 years from the date of plan approval |

labor productivity |

During the planning period, labor productivity will increase by an average of 3% or more per year compared to the base year (the end of the most recent fiscal year). |

Types of advanced equipment, etc. |

The following equipment is used directly for production, sales activities, etc. necessary to improve labor productivity. |

| Plan details | The plan must conform to the national introduction promotion guidelines and Inagi City's introduction promotion basic plan. The plan must be expected to smoothly and reliably introduce cutting-edge equipment, etc. The plan must have been pre-confirmed by a certified management innovation support organization (financial institution, chamber of commerce, professional services, etc.). |

Please refer to the following guidelines when formulating a plan to introduce cutting-edge equipment.

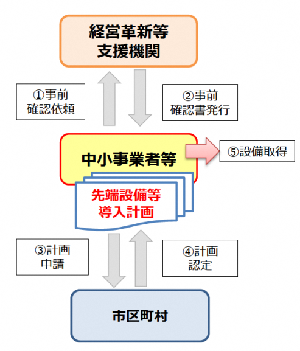

The process for certification of plans to introduce advanced equipment, etc. is as follows.

(1) Create a plan to introduce cutting-edge equipment, etc., and request prior confirmation from a business innovation support organization (financial institutions, chambers of commerce, professional trade, etc.). (2) If the contents are suitable, the business innovation support organization will request (3) Attach the necessary documents such as the “confirmation letter” and apply to Inagi City for a plan to introduce cutting-edge equipment. (4) If the contents are compatible, Inagi City will issue a “certification letter.” (5) After issuance of the “Notice of Certification”, acquire equipment based on the certified cutting-edge equipment introduction plan.

Note: Acquisition of advanced equipment, etc. must be done after the "Advanced Equipment Introduction Plan" has been certified, so please be careful about the acquisition timing.

Note: When formulating the "Advanced Equipment Introduction Plan," please refer to the above-mentioned "Guidelines for Formulating an Advanced Equipment Introduction Plan."

When applying for the "Advanced Equipment Introduction Plan," labor productivity is expected to improve by an average of 3% or more per year by introducing equipment that will be used directly for production, sales activities, etc. necessary for improving labor productivity. Regarding this, it is essential that a business innovation support organization (financial institution, chamber of commerce, professional industry, etc.) obtain prior confirmation and issue a "confirmation letter."

You can check the management innovation support organizations under the jurisdiction of the Kanto Bureau of Economy, Trade and Industry from the Kanto Bureau of Economy, Trade and Industry website below.

When applying for certification, please submit one copy of the following application documents.

(1) Certification application form, advanced equipment introduction plan (notes: 1)

(2) Prior confirmation letter (copy) from a certified management innovation support organization

(3) Inspection of city tax taxation/payment status and copying consent form (4) Pledge regarding exclusion of organized crime groups Notes: 1 Established in the Enforcement Regulations of the Act on Special Measures for Productivity Improvement Related to the Ministry of Economy, Trade and Industry.

Documents required when receiving special measures for fixed asset tax <br id="3"/>In addition to (1) to (4) above, the following documents (5) Investment plan issued by a certified management innovation support organization confirmation letter regarding

When introducing leased equipment and receiving relief measures <br id="3"/>When the user of the equipment and the person who pays the fixed asset tax are different (it is an ownership transfer lease and the leasing company pays the fixed asset tax) (applicable even if you are responsible for the expenses), in addition to (1) to (5) above, the following documents.

(6) Lease contract estimate (copy)

(7) Reduction calculation statement (copy) confirmed by the Lease Business Association

If you wish to announce a policy of raising wages (if you wish to receive a 1/3 reduction in fixed property tax) <br id="3"/>In addition to the documents listed above (1) to (5) (or (1) to (7) in the case of leasing), the following documents are required.

(9) Written note certifying that a wage increase policy has been announced to employees: A wage increase policy can only be included in the plan when applying for a new position.

Note: Wage increase policies cannot be added to a plan when submitting a change.

(1) (In the case of a change application) Certification application form, advanced equipment introduction plan Note: Please create a revised version of the certified "advanced equipment introduction plan."

Note: Please underline any changes or additions to make it easier to see the changes.

(2) Prior confirmation letter from a certified management innovation support organization (3) Copy of the previous advanced equipment introduction plan (copy of the one returned after certification)

Note: Please write by hand in the plan that this is the plan before the change.

[When equipment that is subject to tax measures is included]

(4) Confirmation regarding investment plan issued by a certified management innovation support organization (5) Lease contract estimate (copy)

(6) Reduction calculation statement (copy) confirmed by the Lease Business Association

Reception hours <br id="3"/>8:30 a.m. to 5:15 p.m.

How to apply <br id="3"/>By mail or in person

Submit to <br id="3"/>Inagi City Hall, Industry, Culture and Sports Department, Economy Division, Commerce and Industry Section

Documents required when receiving special measures for fixed asset tax

Inagi City Hall, Citizens' Affairs Department, Taxation Division, Housing Section

Inagi City Industry, Culture and Sports Department Economic Division Phone: 042-378-2111